Holder Distribution

The Holder Distribution assessment evaluates how widely a token’s supply is distributed among holders. A higher holder distribution score suggests a more decentralized token, reducing risks associated with whale concentration and market manipulation.

Assessing decentralization through holder count and whale concentration

Factors Considered in Holder Distribution

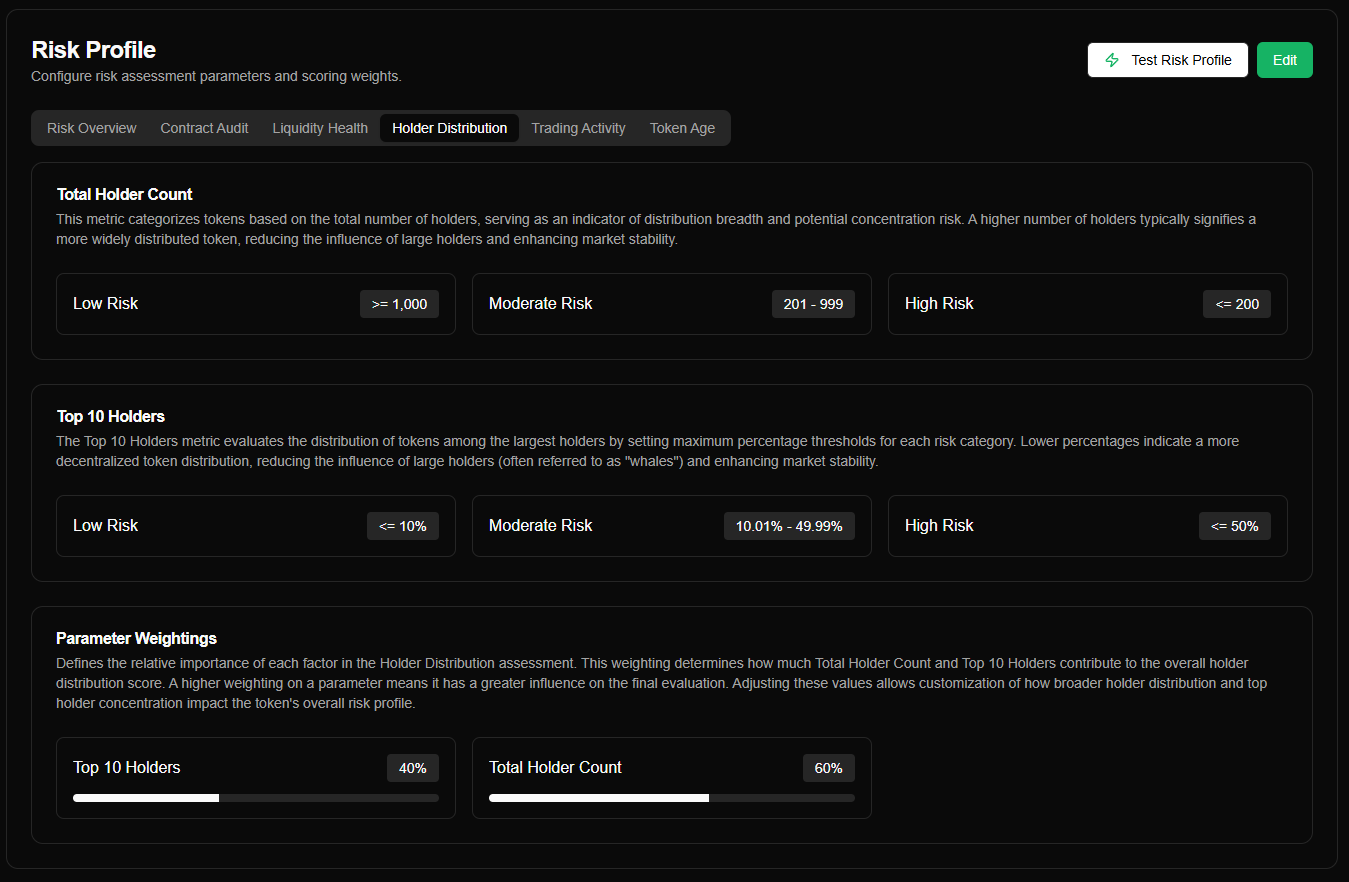

Total Holder Count

- Measures the total number of unique wallets holding the token.

- A higher holder count suggests greater decentralization, reducing reliance on a small number of large investors.

- A lower holder count means the token may be highly concentrated, increasing the risk of manipulative price swings.

Top 10 Holders

- Evaluates the percentage of total supply held by the top 10 wallets.

- Lower percentages indicate a more decentralized token with fewer risks of whale-driven volatility.

- Higher percentages suggest that a few large holders control a significant portion of the supply, increasing liquidation risks.

Parameter Weightings

Within the Holder Distribution category, each factor is assigned a weighting to define its influence on the final holder distribution score.

- Total Holder Count Weighting – Determines the importance of distribution breadth.

- Top 10 Holders Weighting – Defines how large holder concentration affects risk assessment.

Note: These weightings apply within the Holder Distribution category.

The overall Holder Distribution score can be further adjusted using Global Risk Weightings in the Risk Overview tab.

By analyzing holder distribution, your agent can prioritize decentralized tokens and mitigate risks associated with whale dominance.