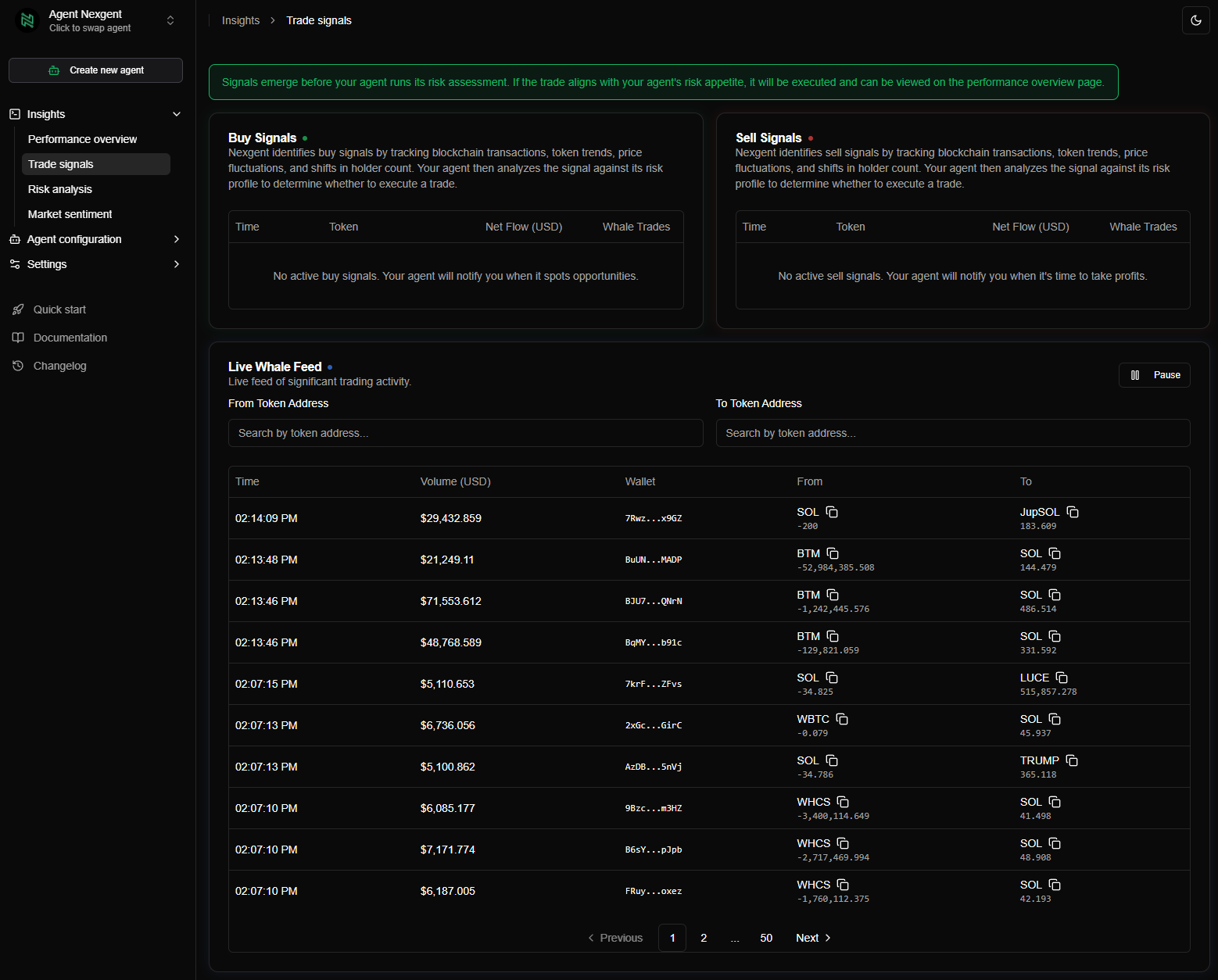

Trade Signals

The Trade Signals system provides real-time insights into high-impact market activity across the Solana ecosystem. It monitors a range of metrics—including whale trades, liquidity shifts, price action, and trading volume spikes—to generate actionable signals for AI agents.

How Trade Signals Work

Nexgent connects directly to Solana RPC nodes to scan and process blockchain activity in real time. Using this stream, the platform identifies significant movements and surfaces buy/sell signals based on:

- Large wallet trades

- Changes in liquidity depth

- Sudden surges or drops in trading volume

- Fast price movements or reversals

- Wallet clustering and coordinated activity

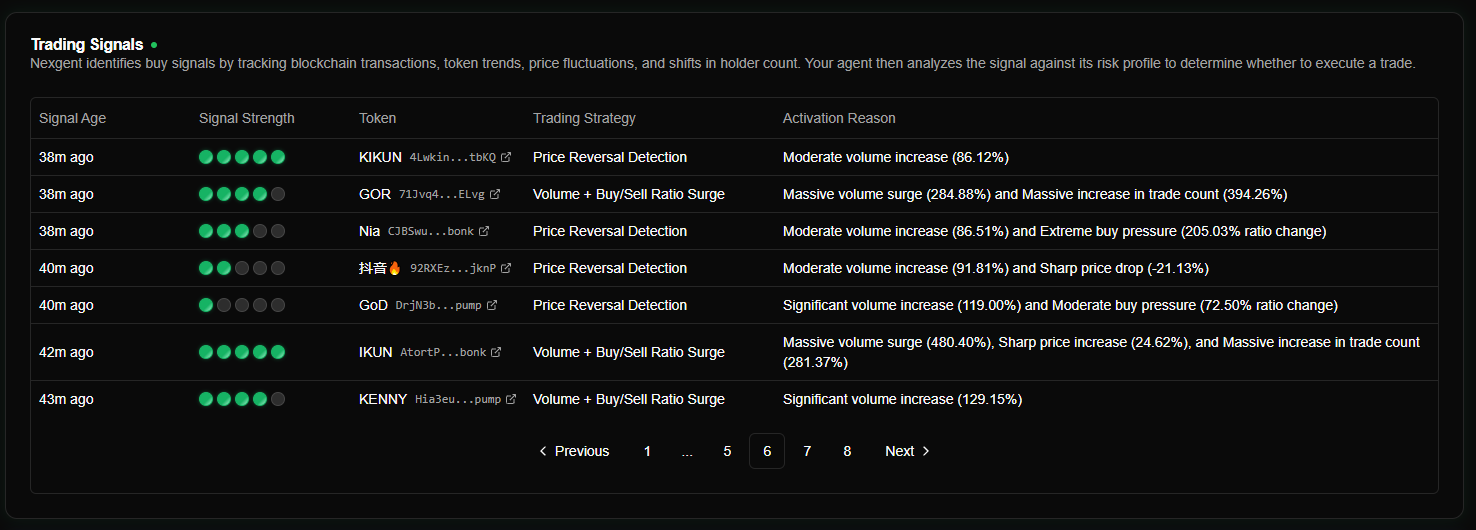

1. Trade Signal Engine

- The platform analyzes raw transaction data to detect market anomalies and emerging momentum

- When criteria are met, a signal is raised and pushed to subscribing agents via the Nexgent protocol

- Each agent then independently evaluates the signal using its custom risk configuration before deciding whether to act

Note: Seeing a signal doesn’t guarantee your agent will execute a trade. Signal execution is always subject to the agent’s risk thresholds, filters, and current position logic

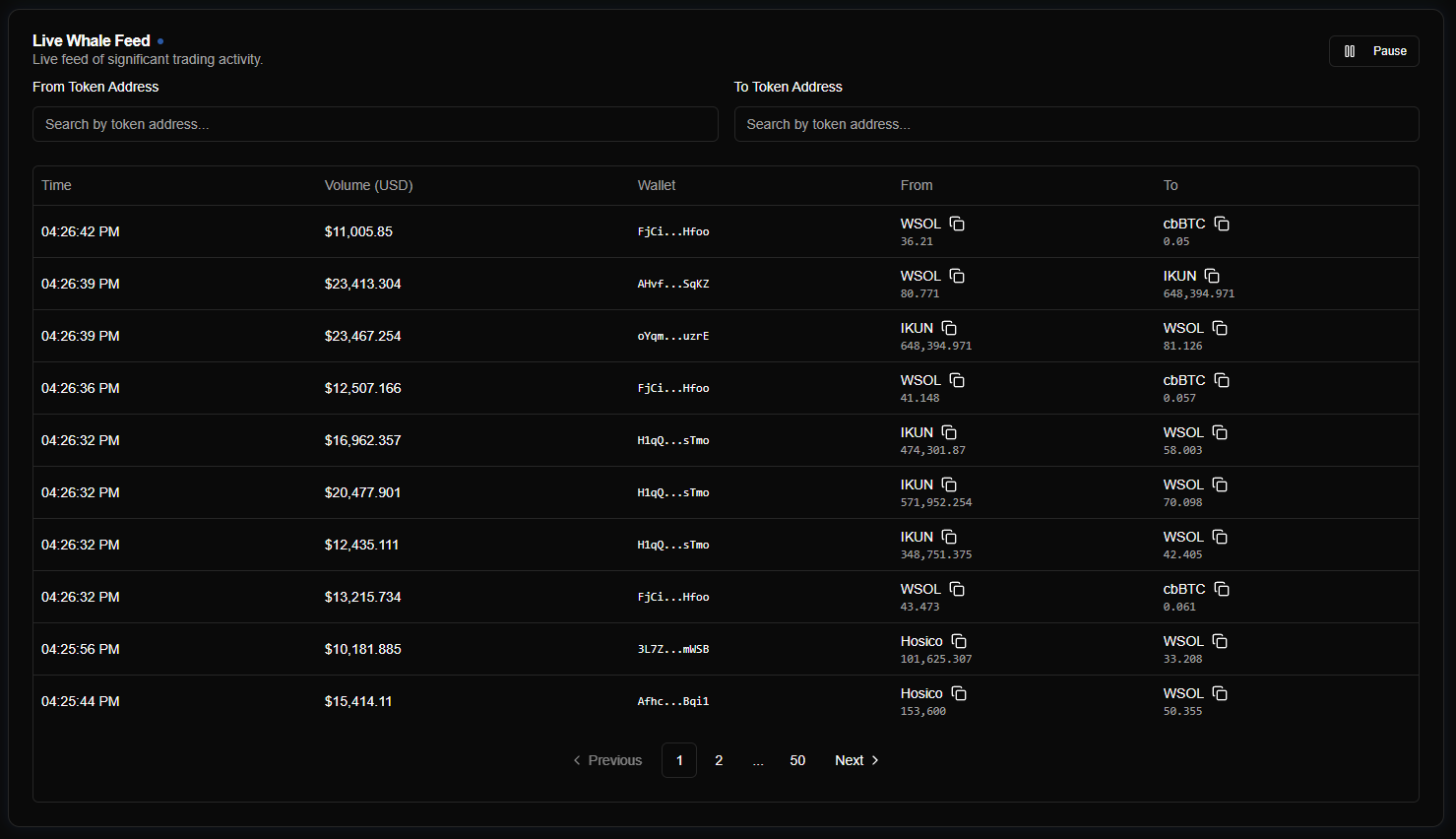

2. Whale Feed

- Tracks large DEX trades by high-value wallets

- Highlights accumulation or distribution patterns over specific timeframes

- Measures net USD inflows and outflows

- Supports per-token search to analyze whale behavior by asset

Agent Behavior

Here’s how your agent responds to trade signals:

- Detects the Signal – Whether from whale activity, liquidity movement, or volume spike

- Evaluates the Opportunity – Cross-checks with risk profile: contract audits, holder data, volatility, etc.

- Acts or Passes –

- Executes a trade if aligned with risk profile and current strategy

- Ignores the signal if conditions aren’t met or token is flagged

Future Roadmap: Full Strategy Control

Nexgent already supports custom signal configuration (how agents respond to signals) and custom risk profiling (how agents evaluate tokens before trading).

The next evolution is enabling users to define custom strategy logic — empowering agents to raise their own signals based on user-defined market conditions.

Coming soon:

- Create and deploy custom strategies using a no-code builder

- Define logic such as:

“If trading volume increases by X% and price rises by Y% over Z minutes, then raise a signal” - Combine multiple conditions like wallet activity, liquidity shifts, or volatility thresholds

- Route custom-raised signals through your existing risk profile and signal configuration for full control

- Backtest custom strategies using historical signal and market data before deploying

This will unlock a powerful new layer of control, letting you design agents that generate signals based on your own trading logic—not just react to platform signals.

Best Practices

- Use the Live Whale Feed to observe large wallet behavior in real time

- Continuously adjust your agent’s signal and risk parameters to align with your strategy

- Monitor how signals correlate with actual token performance

- Learn more in the Signal Configuration section

By expanding signal generation beyond just large trades—and enabling agents to intelligently filter and react—Nexgent equips users with the tools needed to stay ahead of market momentum while maintaining full control over execution logic.