Risk Overview

The Risk Overview page provides a comprehensive breakdown of how risk is evaluated within Nexgent’s AI trading system. By understanding how different risk factors contribute to the overall risk score, you can fine-tune your agent’s decision-making process.

Customize how different risk factors contribute to the overall risk assessment

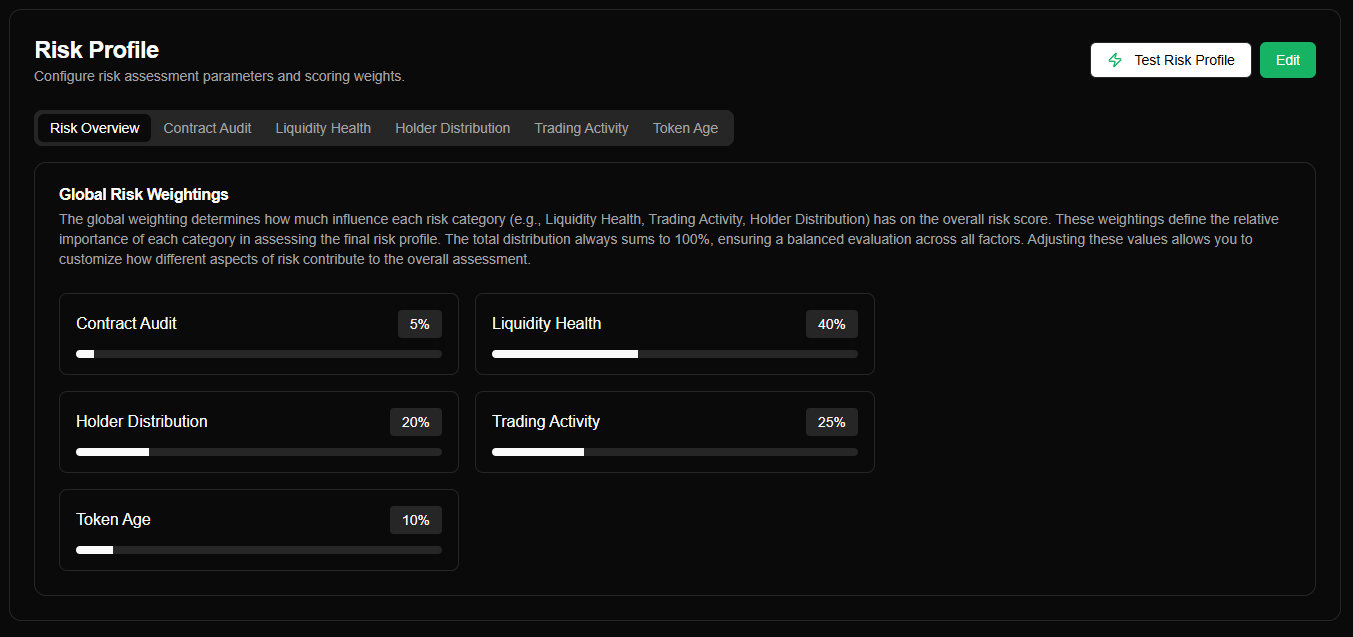

Global Risk Weightings

The Global Risk Weighting system determines how much influence each risk category has on the final risk score.

How It Works

- Each risk category (e.g., Liquidity Health, Trading Activity, Holder Distribution) is assigned a weight percentage.

- These weightings must sum to 100%, ensuring a balanced evaluation across all factors.

- Adjusting these values customizes how different risk aspects contribute to the final risk assessment.

Customizing Global Risk Weighting

- Increase a category’s weight to make it a higher priority in the risk evaluation.

- Decrease a category’s weight if you consider it less critical to risk determination.

- This flexibility allows you to align the agent’s risk model with your personal trading strategy.

Each risk category has its own parameters and scoring criteria. Click below to explore each factor in detail:

- Contract Audit – Analyzing smart contract security & immutability.

- Liquidity Health – Evaluating liquidity stability and market cap correlation.

- Holder Distribution – Measuring decentralization and whale influence.

- Trading Activity – Assessing volume trends, buy/sell ratios, and market sentiment.

- Token Age – Understanding token maturity and historical performance.

By fine-tuning the Global Risk Weighting, you can optimize your agent’s ability to assess risk in a way that matches your investment approach.