Trading Activity

The Trading Activity assessment evaluates key metrics that determine how actively a token is being traded. A higher trading activity score suggests strong market engagement and liquidity, while a lower score may indicate risks such as low demand, illiquidity, or potential manipulation.

Factors Considered in Trading Activity

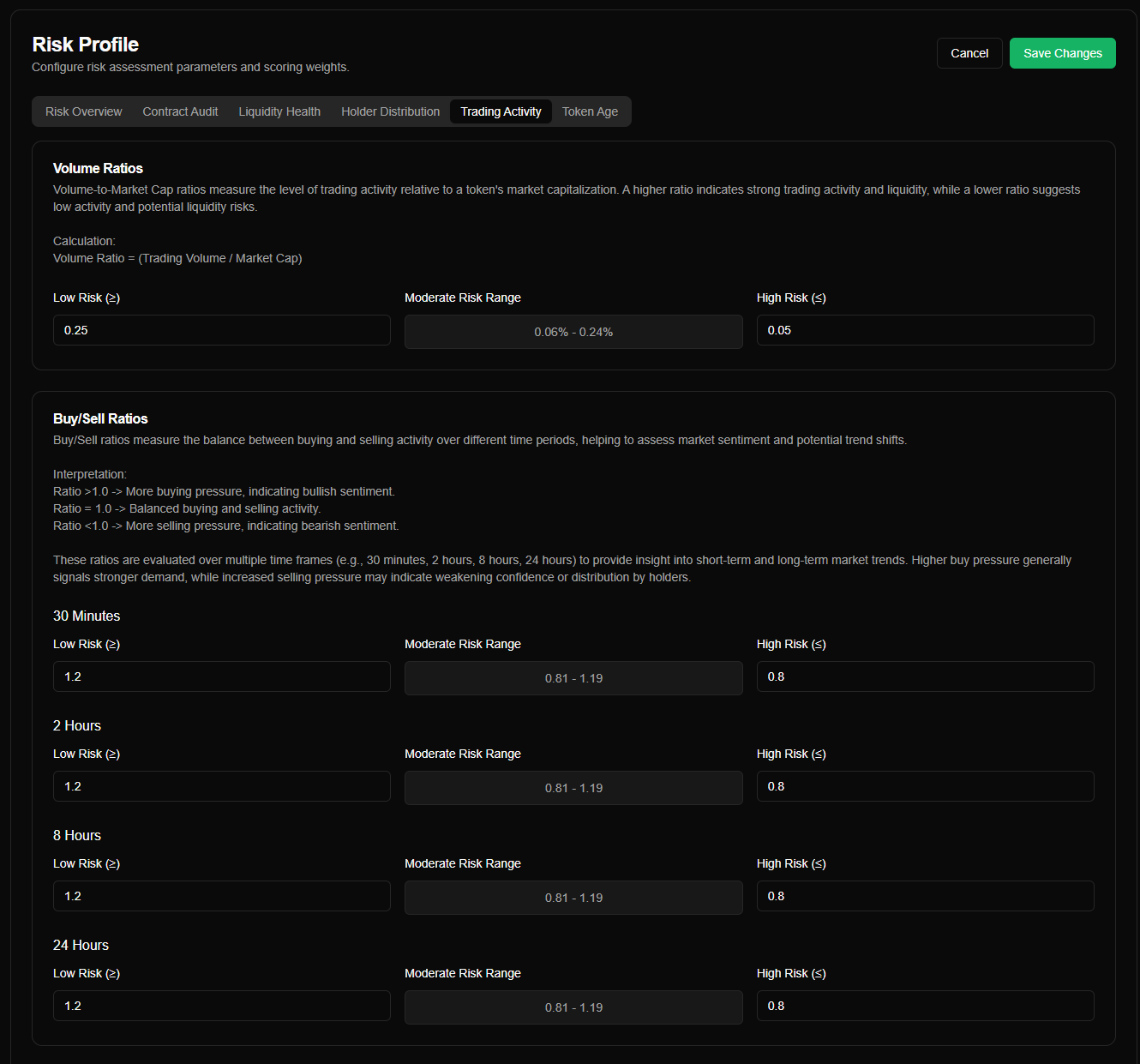

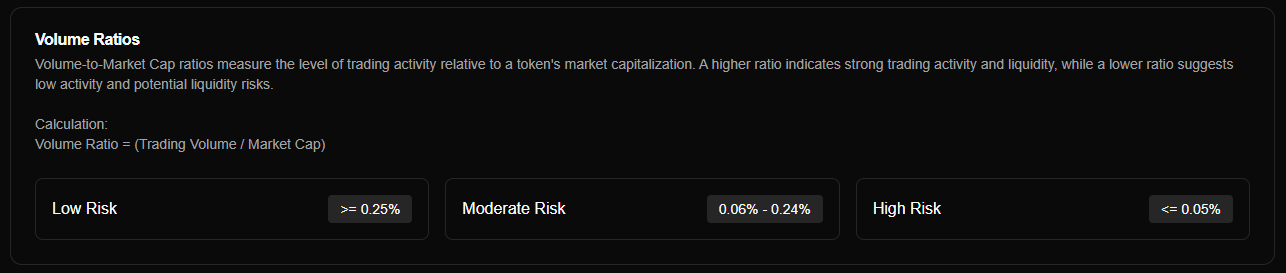

Volume Ratios

The Volume-to-Market Cap ratio measures the level of trading activity relative to a token’s market capitalization.

Formula: Volume Ratio = (Trading Volume / Market Cap)

- A higher ratio indicates strong trading activity and better liquidity.

- A lower ratio suggests low activity, making the token prone to liquidity risks.

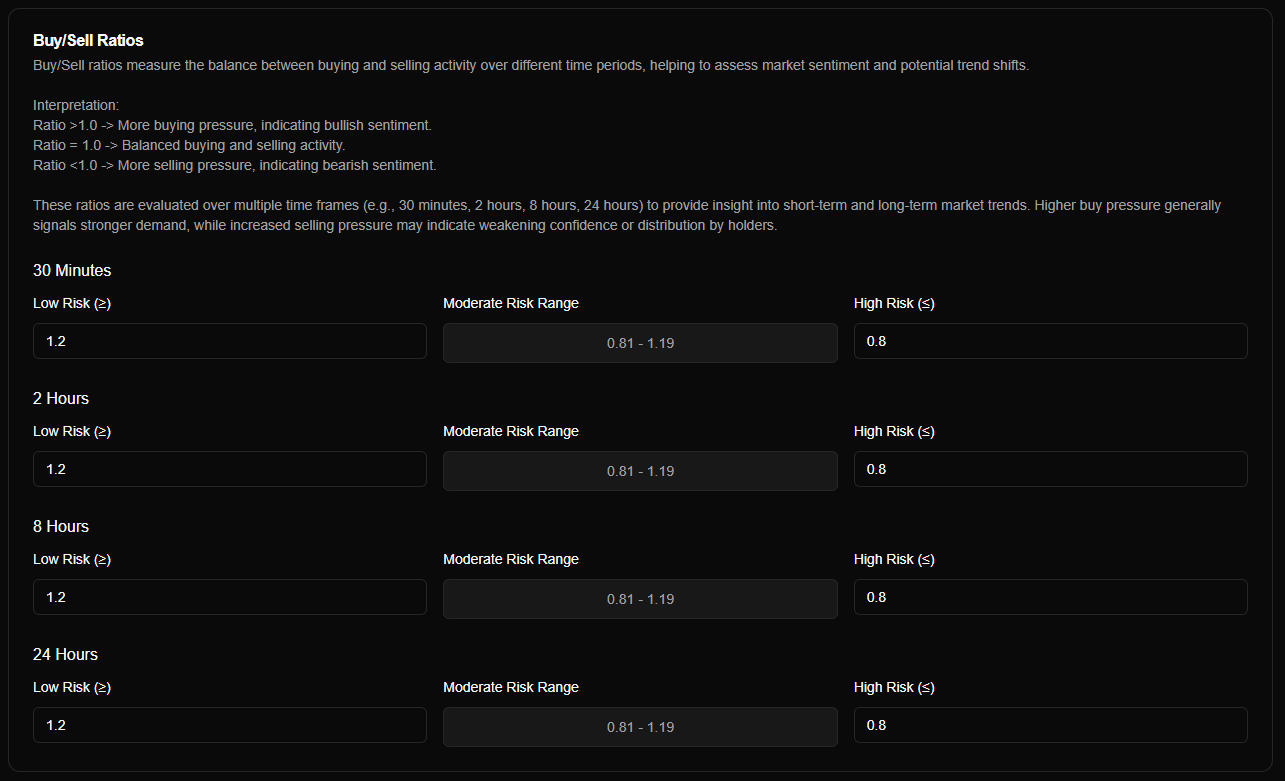

Buy/Sell Ratios

The Buy/Sell ratio evaluates market sentiment by analyzing the balance between buying and selling pressure over different time frames.

Interpretation:

- Ratio > 1.0 → More buying pressure (bullish sentiment).

- Ratio = 1.0 → Balanced buying and selling activity.

- Ratio < 1.0 → More selling pressure (bearish sentiment).

These ratios are assessed over multiple time frames (30 minutes, 2 hours, 8 hours, 24 hours) to provide insights into both short-term and long-term trends.

- Higher buy pressure signals stronger demand.

- Increased selling pressure may indicate weakening confidence or distribution by holders.

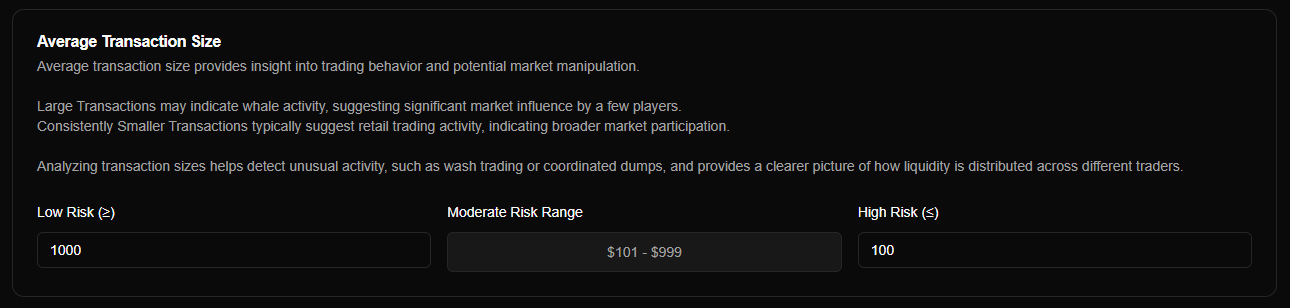

Average Transaction Size

This metric provides insight into trading behavior and potential market manipulation.

- Large transactions suggest whale activity, where a few players control significant market influence.

- Consistently small transactions indicate retail trader activity, reflecting broader market participation.

Why It Matters:

Analyzing transaction sizes helps detect unusual activity, such as:

- Wash trading (fake volume to manipulate rankings).

- Coordinated dumps (whales offloading tokens simultaneously).

- Organic vs. artificial trading patterns.

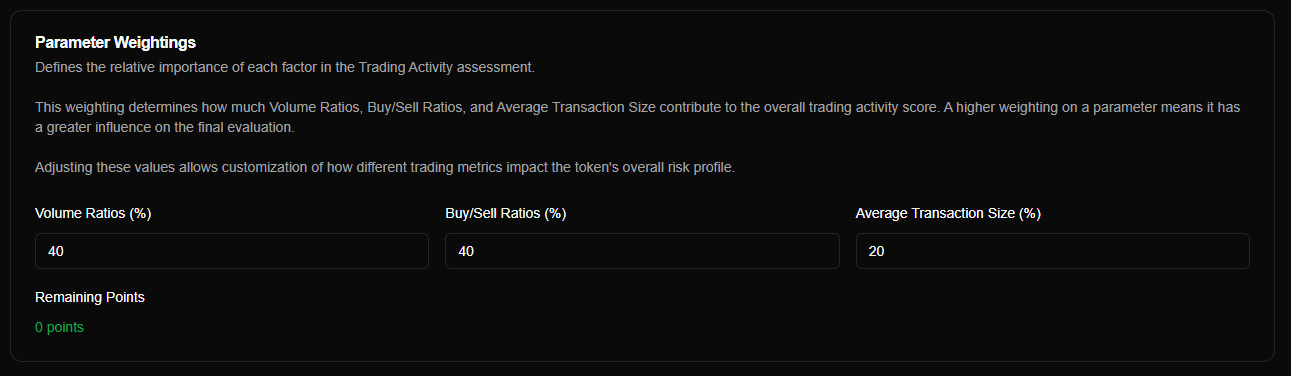

Parameter Weightings

Each factor in Trading Activity is assigned a weighting to define its influence on the final trading activity score.

- Volume Ratios Weighting – Measures how significant trading volume is in risk assessment.

- Buy/Sell Ratios Weighting – Evaluates how buying vs. selling pressure impacts market sentiment.

- Average Transaction Size Weighting – Determines the importance of whale activity vs. retail trader participation.

Note: These weightings apply within the Trading Activity category.

The overall Trading Activity score can be further adjusted using Global Risk Weightings in the Risk Overview tab.

By analyzing trading activity, your agent can detect liquidity risks, identify potential trends, and avoid tokens with signs of market manipulation.