Liquidity Health

The Liquidity Health assessment evaluates how well a token’s liquidity supports its market capitalization. A higher liquidity health score indicates that a token can be traded efficiently with minimal risk of price slippage, while a lower score suggests liquidity challenges that could lead to volatile price movements.

Factors Considered in Liquidity Health

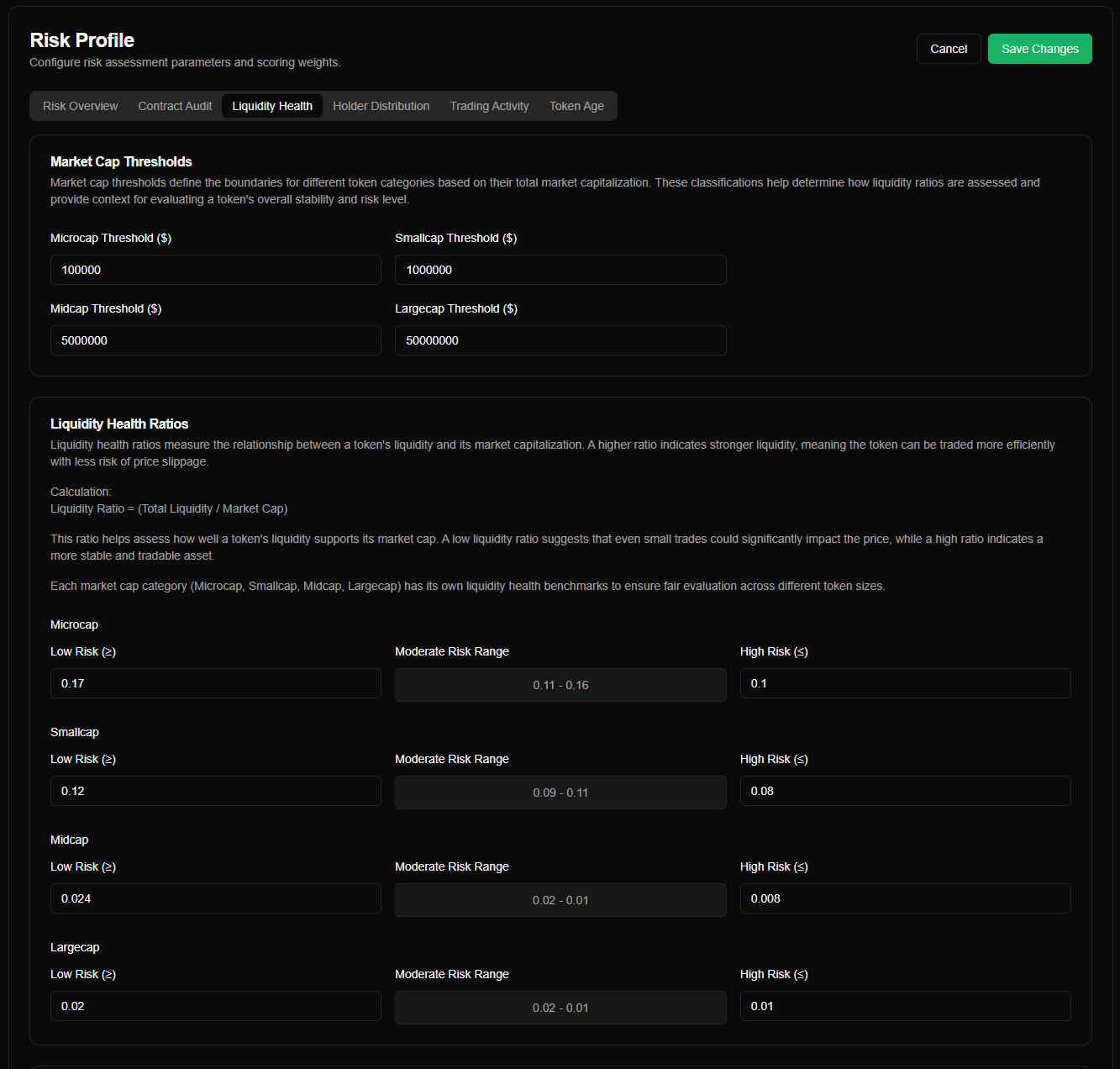

Market Cap Thresholds

Tokens are categorized based on market capitalization to ensure fair liquidity evaluation. These classifications help assess how liquidity ratios are measured and provide context for stability and risk levels.

Market cap categories include:

- Microcap – High risk, low liquidity.

- Smallcap – Moderate risk, with variable liquidity.

- Midcap – Established tokens with stable liquidity.

- Largecap – High liquidity, lower risk of slippage.

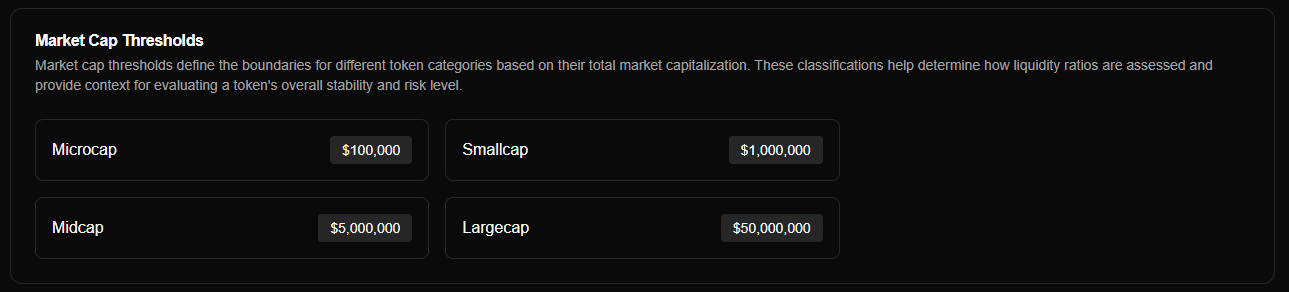

Liquidity Health Ratios

The Liquidity Ratio measures the relationship between a token’s liquidity and its market cap.

Formula: Liquidity Ratio = (Total Liquidity / Market Cap)

- A high ratio suggests strong liquidity, allowing for efficient trading with minimal price impact.

- A low ratio indicates weak liquidity, where even small trades could cause significant price shifts.

Each market cap category has predefined liquidity benchmarks to ensure an accurate risk evaluation.

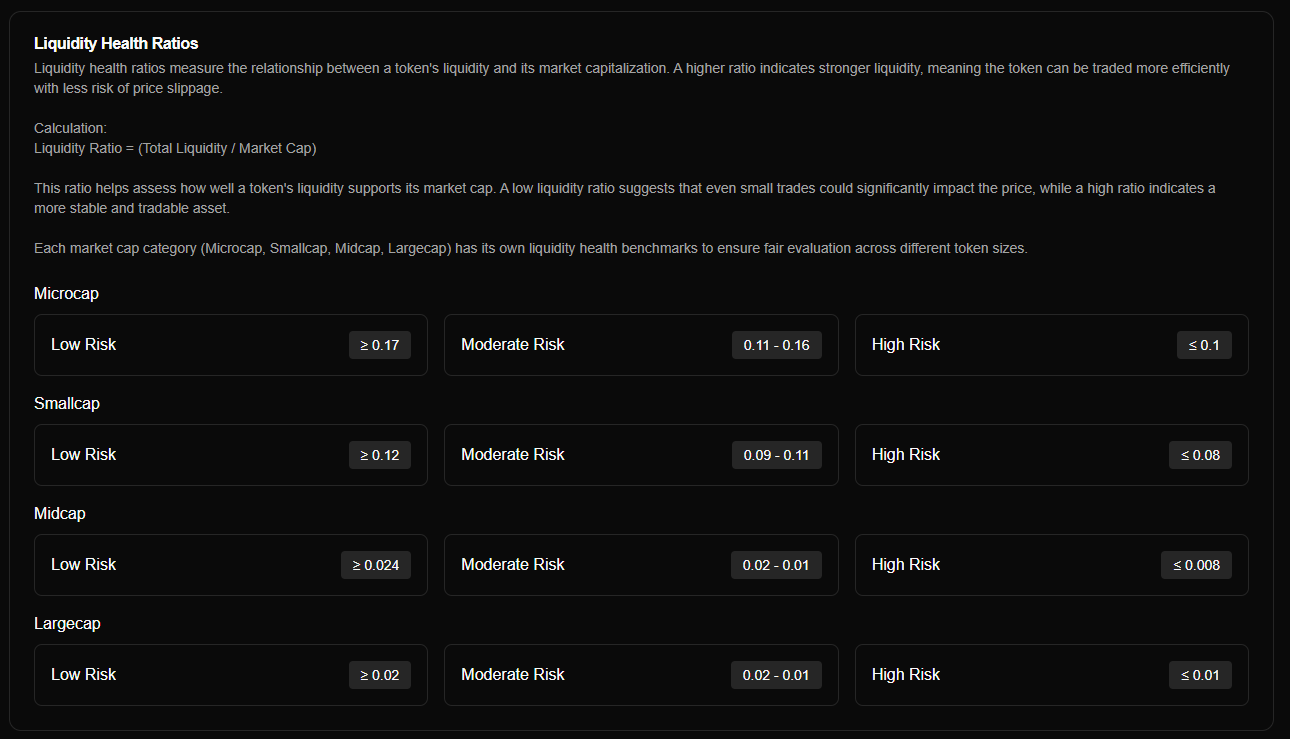

Number of Markets

The Number of Markets metric tracks how many trading pairs or exchanges list the token.

- A higher number suggests that the token is well-established and liquid.

- A lower number means the token is newer or less actively traded, increasing risk.

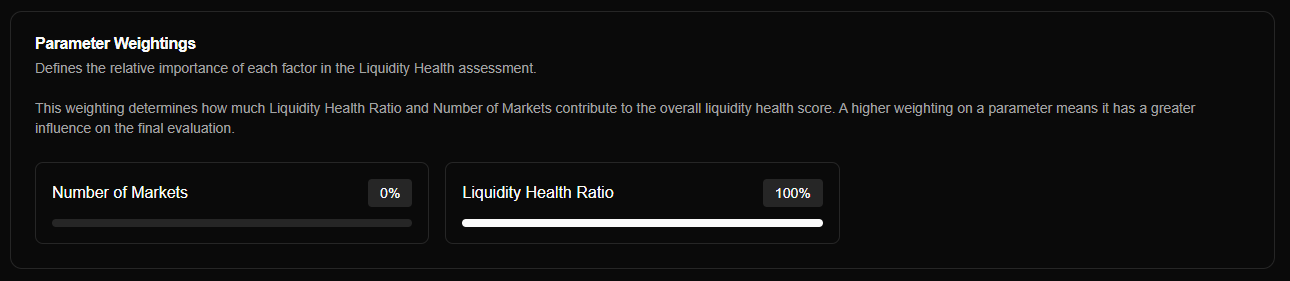

Parameter Weightings

Within the Liquidity Health category, each factor is assigned a weighting to define its importance in the final liquidity score.

- Liquidity Ratio Weighting – Determines how strongly the liquidity-to-market cap relationship influences the score.

- Number of Markets Weighting – Defines the impact of exchange/trading pair availability.

Note: These weightings only apply within the Liquidity Health category.

The overall Liquidity Health score can be further adjusted using Global Risk Weightings in the Risk Overview tab.

By analyzing these liquidity factors, your agent can prioritize stable, tradable tokens while avoiding assets prone to liquidity-driven volatility.