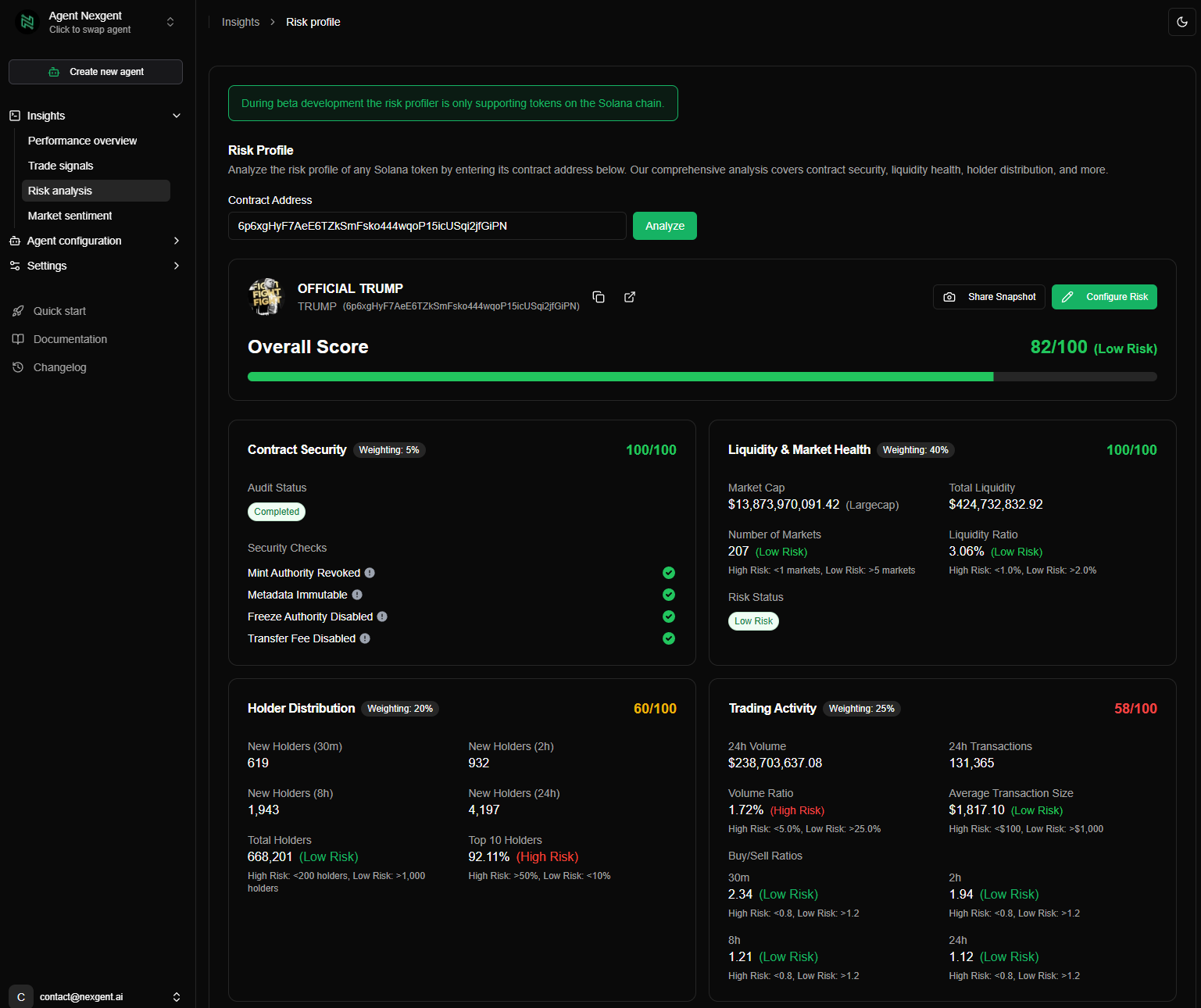

Risk Analysis

The Risk Assessment page allows you to analyze a token’s security and stability by reviewing key risk parameters. Users can enter a token address to see how their agent's risk profile evaluates the token, including both overall and individual risk score breakdowns.

Risk Categories

Risk is evaluated across five main categories:

- Contract Audit – Assessing the security and immutability of the token contract.

- Liquidity Health – Evaluating how well the token’s liquidity supports its market cap.

- Holder Distribution – Measuring decentralization and whale influence.

- Trading Activity – Analyzing volume trends, buy/sell ratios, and transaction sizes.

- Token Age – Understanding how long the token has been in circulation and its stability over time.

Each section within these categories can be assigned a weighting, and an overall risk weighting can be applied per category to fine-tune the evaluation.

Contract Audit

The Contract Security evaluation assesses key risk factors related to the token’s smart contract. Higher security scores indicate a more immutable contract, reducing the risk of manipulation.

Key Security Parameters:

- Mint Authority Revoked – Ensures no additional tokens can be minted, preventing inflation.

- Freeze Authority Disabled – Prevents anyone from restricting token transfers.

- Transfer Fee Disabled – Confirms that unexpected fees won't impact trading.

- Metadata Immutable – Ensures core token details (name, symbol, and URI) cannot be altered.

A higher contract security score signifies a safer contract with fewer risks of exploits or malicious updates.

Liquidity Health

Liquidity health measures how easily a token can be traded without significant price impact.

Market Cap Thresholds

Market caps are categorized to provide relevant liquidity benchmarks for Microcap, Smallcap, Midcap, and Largecap tokens.

Liquidity Health Ratio

The Liquidity Ratio assesses how well a token’s liquidity supports its market cap.

Formula: Liquidity Ratio = (Total Liquidity / Market Cap)

- A higher ratio means stronger liquidity, reducing price slippage.

- A lower ratio suggests that even small trades could significantly impact price.

Number of Markets

This metric tracks the number of exchanges or trading pairs where the token is listed. A higher number generally indicates a more established and liquid asset.

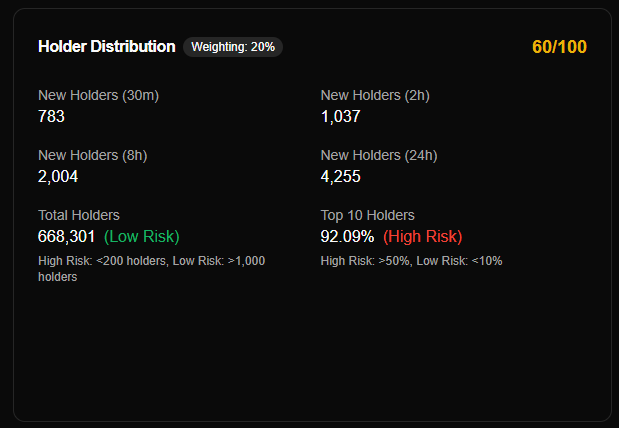

Holder Distribution

Holder distribution provides insight into token decentralization and whale concentration.

Total Holder Count

- Measures the number of unique wallets holding the token.

- A higher holder count suggests better decentralization and stability.

Top 10 Holders

- Evaluates the percentage of supply held by the top 10 wallets.

- Lower concentration among whales indicates lower risk of price manipulation.

A highly decentralized token reduces the risk of sudden price drops due to large holder sell-offs.

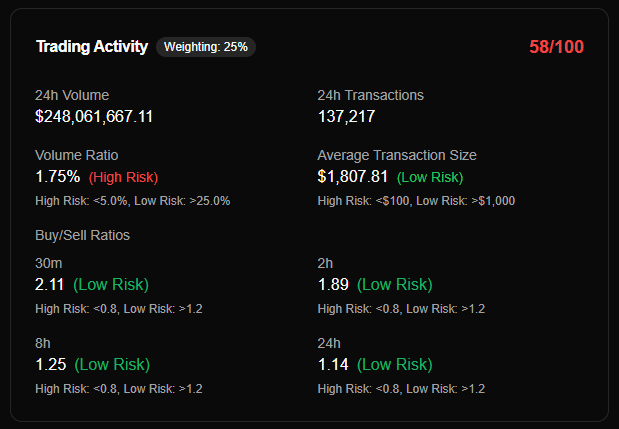

Trading Activity

The Trading Activity section analyzes volume trends, market sentiment, and liquidity risks.

Volume Ratios

- Measures trading volume relative to market cap.

- Higher volume indicates stronger liquidity and price stability.

Formula: Volume Ratio = (Trading Volume / Market Cap)

Buy/Sell Ratios

- Tracks the balance between buying and selling pressure over different timeframes.

- Helps identify bullish vs. bearish sentiment.

Interpretation:

- Ratio > 1.0 → More buying pressure (bullish).

- Ratio = 1.0 → Balanced buying and selling.

- Ratio < 1.0 → More selling pressure (bearish).

These ratios are assessed over multiple timeframes (30 min, 2 hr, 8 hr, 24 hr) to analyze short-term and long-term trends.

Average Transaction Size

- Large transactions may indicate whale activity.

- Smaller transactions typically suggest retail trader activity.

By analyzing transaction sizes, we can detect potential wash trading, pump-and-dump schemes, or coordinated market moves.

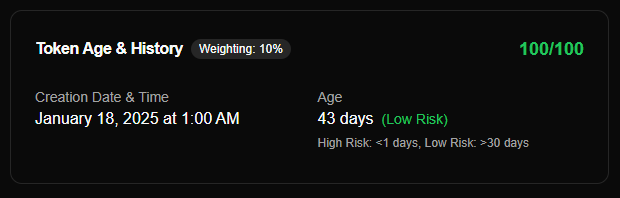

Token Age

The Token Age parameter provides insights into the maturity and reliability of a token.

- Older tokens are generally considered lower risk due to proven stability.

- Newer tokens are higher risk, as they may lack liquidity, historical data, or long-term stability.

Tokens are categorized based on the number of days since launch, allowing agents to assess their risk based on historical resilience.

Customizing Risk Weighting

Each risk category and individual parameter can be assigned custom weightings to reflect a trader's risk tolerance.

For more details on adjusting risk profiles, visit:

Risk Profile Overview