Signals

🚧 This feature is still experimental and will be built out over time. 🚧

The Signals system allows your AI agent to track market movements and identify potential trading opportunities. By customizing signal parameters, you can ensure that your agent only detects and alerts you to the most relevant trading signals, reducing noise and optimizing decision-making.

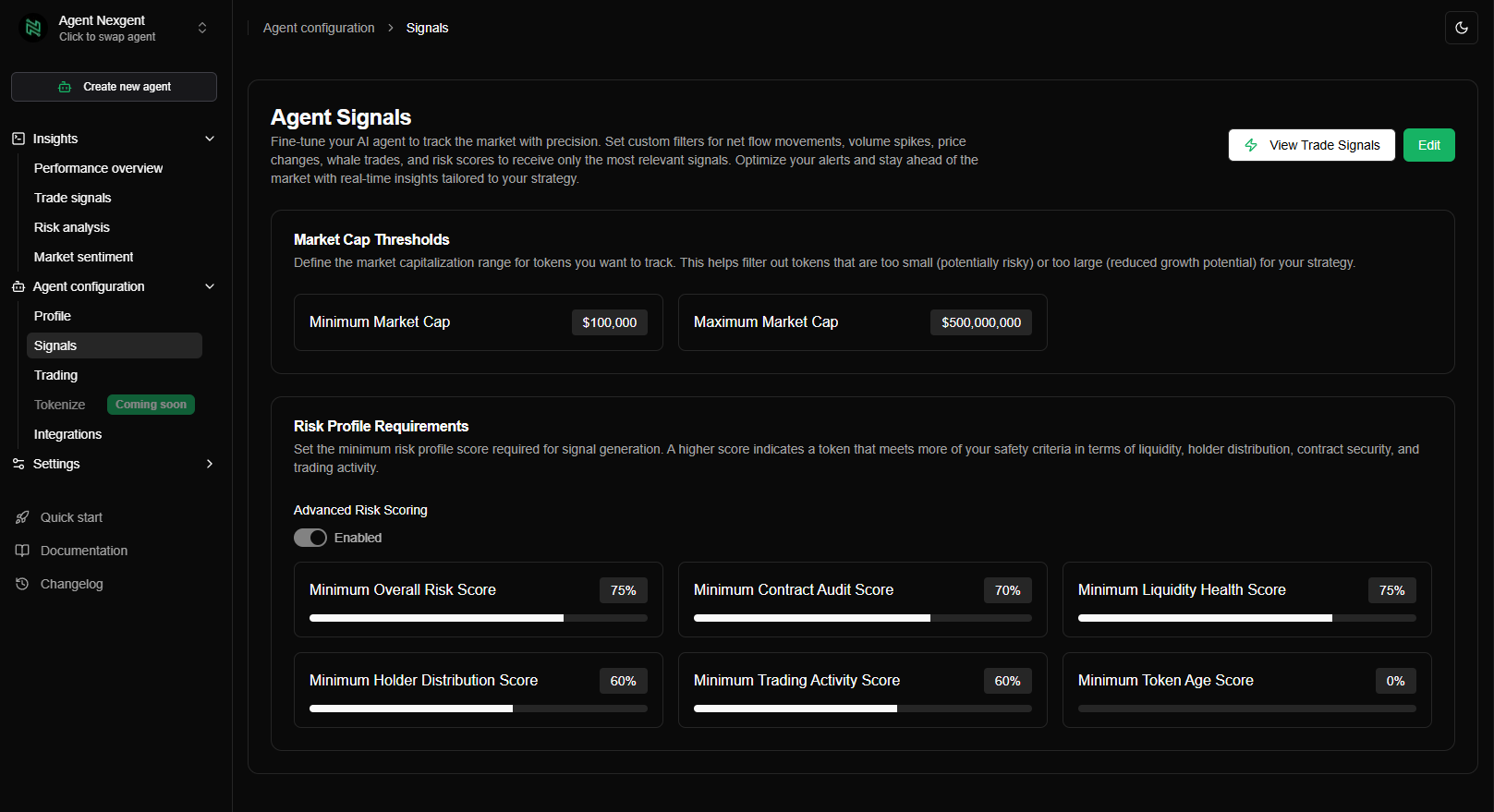

Agent Signals

Fine-tune your AI agent to track the market with precision. Set custom filters for:

- Net Flow Movements – Monitor the inflow and outflow of funds into tokens.

- Volume Spikes – Detect sudden increases in trading volume.

- Price Changes – Track sharp movements in token prices.

- Whale Trades – Identify large transactions from influential wallets.

- Risk Scores – Filter out signals from tokens that don’t meet your risk criteria.

By optimizing these filters, your agent can generate real-time alerts tailored to your strategy.

Market Cap Thresholds

Define the market capitalization range for tokens you want to track.

- Minimum Market Cap – Filters out small-cap tokens that may be high risk or highly volatile.

- Maximum Market Cap – Excludes large-cap tokens that may have lower growth potential.

These filters allow you to focus on the right segment of the market that aligns with your trading strategy.

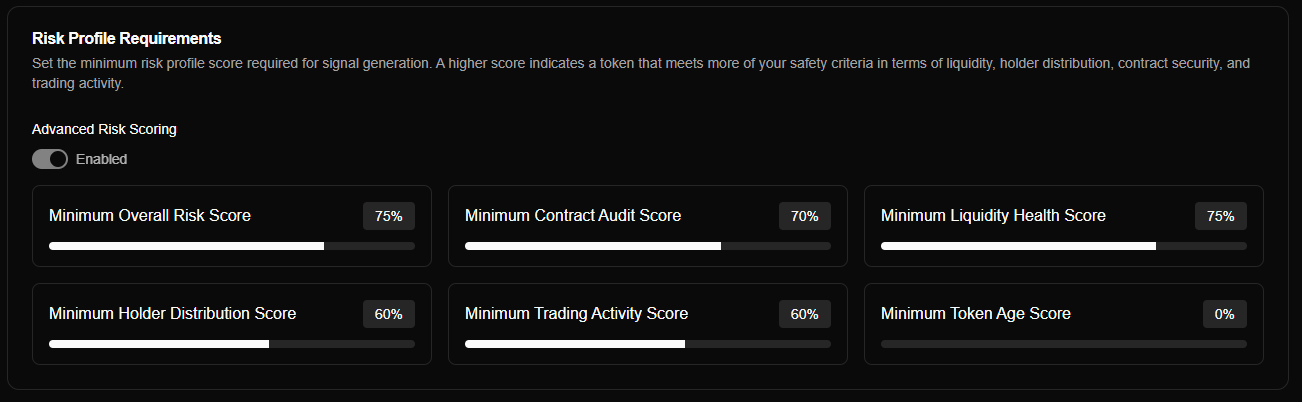

Risk Profile Requirements

Set the minimum risk score required for a signal to be generated.

Basic vs. Advanced Risk Scoring

You can choose between two levels of risk scoring when filtering signals:

Basic Scoring (Overall Risk Score)

- Uses a single overall risk score to determine if a token meets your safety criteria.

- A higher required risk score ensures only lower-risk tokens trigger signals.

Advanced Scoring (Category-Based Minimums)

- Allows you to set minimum required scores for each risk category instead of relying on an overall score.

- Customize thresholds for:

- Liquidity Health

- Holder Distribution

- Contract Security

- Trading Activity

- Token Age

- This provides greater control over how signals are filtered based on specific risk concerns.

By enforcing Risk Profile Requirements, your agent filters out unreliable tokens and focuses on quality opportunities.

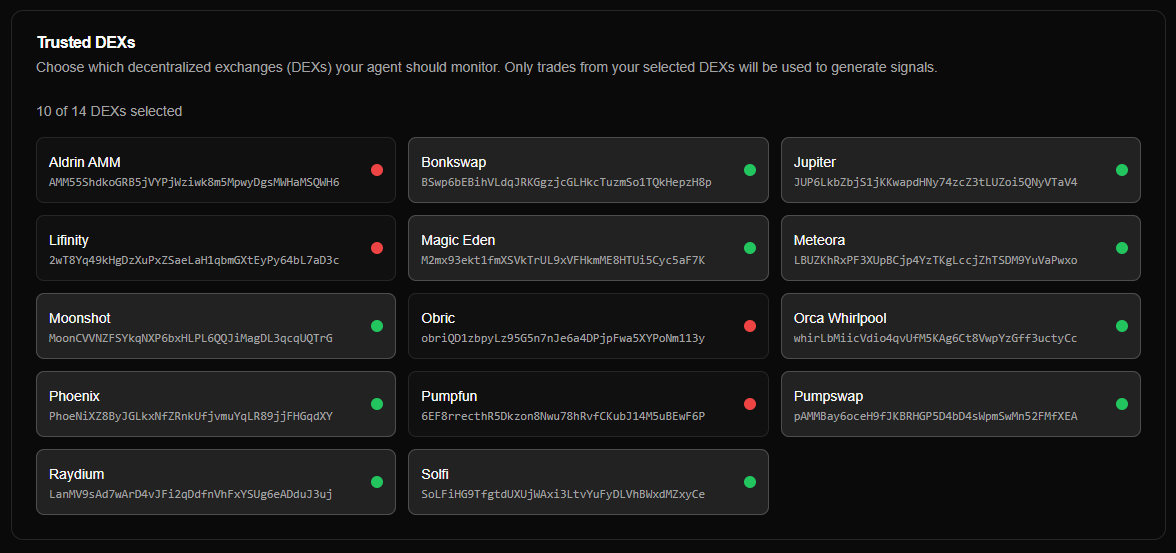

Trusted DEXs

Take full control over where your trading signals are sourced from by configuring Trusted DEXs.

By default, your agent has access to monitor signals across multiple Solana-based decentralized exchanges. With the Trusted DEXs feature, you can now select which DEXs your agent should monitor. Only trades from the selected DEXs will be used to generate signals.

Why it matters:

- More control over signal quality – Exclude DEXs with low volume, poor liquidity, or a high number of spam tokens.

- Tailor to strategy – If your trading strategy favors specific liquidity pools or platforms, you can now match your signal source accordingly.

- Improved performance – Reduce noise and boost performance by limiting signals to trusted and relevant sources.

How to use it:

- Head to the Agent Configuration > Signals section.

- Scroll down to Trusted DEXs.

- Toggle on or off the exchanges you want your agent to use.

- Only trades from selected DEXs will contribute to signal generation.

🔒 Your agent will ignore any trades from DEXs that are not marked as trusted.

This feature gives you an added layer of precision and helps you fine-tune your agent to match your preferred ecosystems and trading preferences.

Related Section:

See how signals are displayed in the Trade Signals Dashboard.

By refining signal filters, your agent can adapt to changing market conditions, helping you stay ahead with real-time actionable insights.