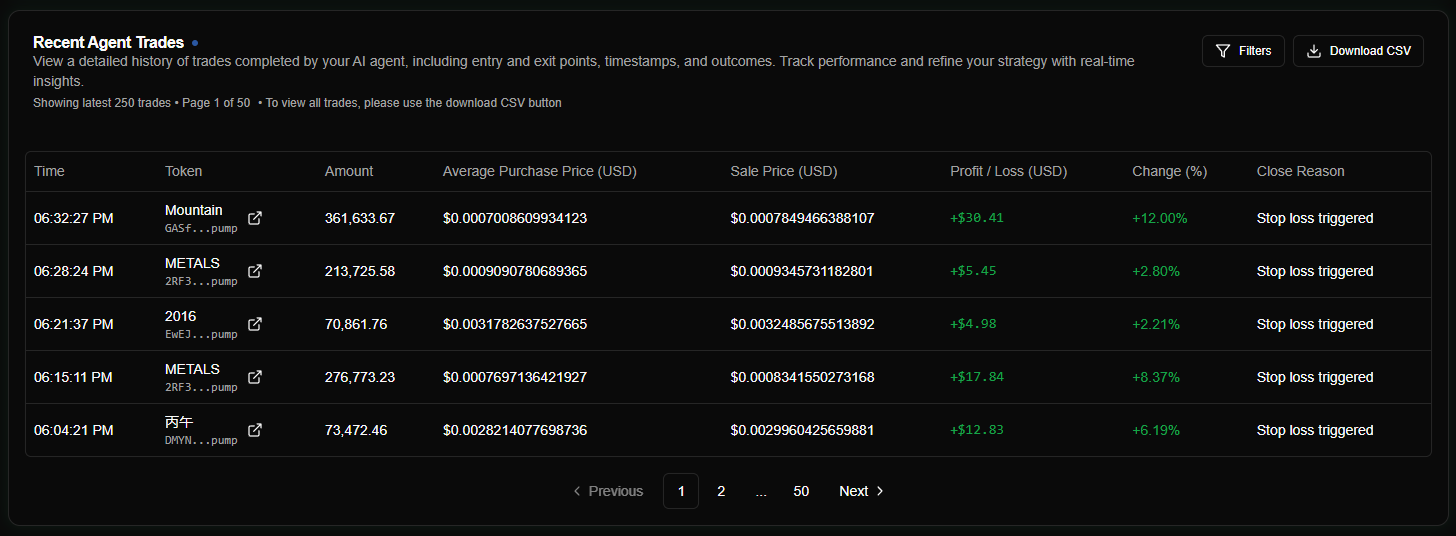

Historical Swaps

Historical swaps represent completed trades - pairs of purchase and sale transactions that form a full trading cycle. They track the entire lifecycle from entry to exit, providing the basis for all performance metrics and tax reporting.

Overview

A historical swap is created automatically when a position is closed. The system pairs the original purchase (including any DCA buys) with the final sale to calculate realized profit or loss.

Lifecycle of a Swap

- Entry: Agent executes a

SWAP(SOL → Token). - Monitoring: Position is tracked; weighted average price updates if DCA buys occur.

- Exit: Position closure is triggered via Manual Close, Stop Loss, or Stale Trade.

- Realization: The system executes the final

SWAP(Token → SOL) and asynchronously generates theAgentHistoricalSwaprecord. - Analytics: Performance metrics (Win Rate, Average Return) are updated instantly.

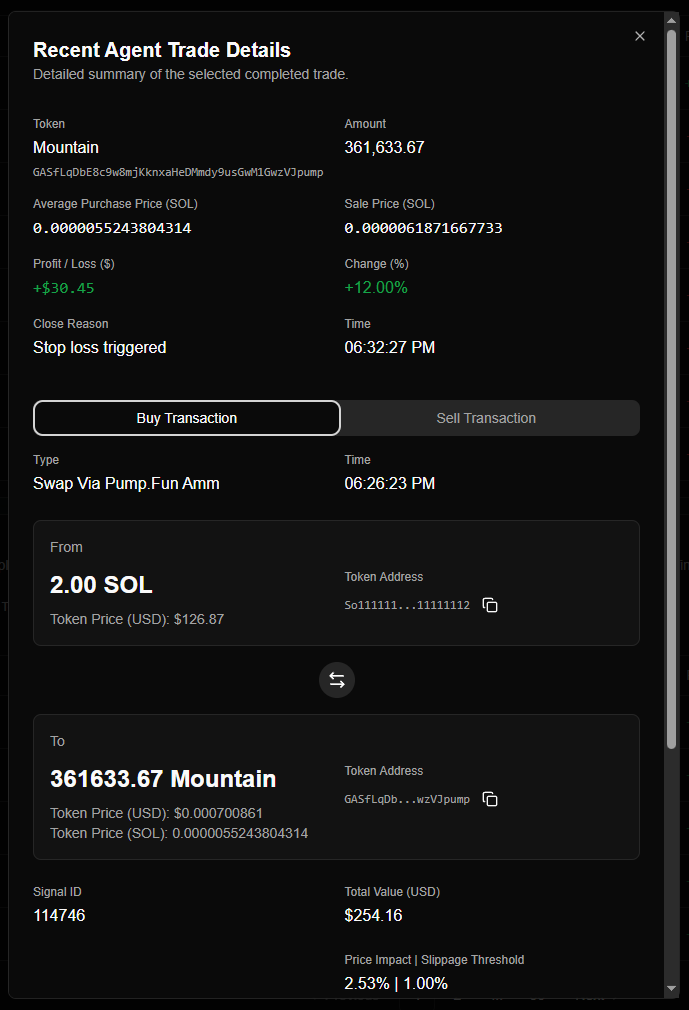

Swap Data Structure

Each record captures the full context of the trade cycle:

| Field | Description |

|---|---|

| amount | Total token amount traded. |

| purchasePrice | Weighted average cost basis per token (accounts for DCA). |

| salePrice | Execution price per token at the time of exit. |

| changePercent | Total price movement percentage from entry to exit. |

| profitLossUsd/Sol | Realized profit or loss in both fiat and native currency. |

| purchase/saleTime | Precise timestamps for entry and exit. |

| closeReason | Why the position was sold (manual, stop_loss, or stale_trade). |

| transactionIds | UUID links to the raw AgentTransaction records. |

Calculations & Cost Basis

Weighted Average Purchase Price

To accurately track P&L when using DCA (Dollar Cost Averaging), Nexgent calculates a weighted average:

Formula: purchasePrice = totalInvestedSol / totalTokensHeld

This ensures that if you "buy the dip," your cost basis decreases, and your profit/loss reflects the true performance of the entire position size.

Realized Profit/Loss

Profit and loss are calculated after the final sale transaction completes:

- SOL P&L:

(salePrice - purchasePrice) * amount - USD P&L:

profitLossSol * solPriceAtExit - Return %:

((salePrice - purchasePrice) / purchasePrice) * 100

Performance & Reporting

Strategic Review

Use the Recent Trades table to analyze your agent's effectiveness:

- Win Rate: The percentage of swaps with a positive

changePercent. - Hold Time: Calculate the duration between

purchaseTimeandsaleTime. - Signal Efficacy: Identify which

signalIdsources lead to the highest returns.

Best Practices

- Audit Regularly: Compare historical swaps against your Agent Activity log to ensure balance reconciliation.

- Correlation Analysis: Check the

signalIdlinked to your best trades to identify high-conviction signal providers. - Mode Awareness: Remember that simulation mode swaps are virtual; always verify your strategy in simulation for 24-48 hours before assigning a live wallet.